Jun 24, 2021

Announcing the Hundred Finance Launch

Since the arrival of programmable smart contracts, blockchains have seen an explosion of interest in permissionless lending platforms. Aave, Compound, Yearn, these are just a few of the projects that have created an interest-bearing use-case for cryptocurrencies that might otherwise lie dormant in wallets, accumulating no added value for their holders. What is more, non-custodial liquidity protocols have also become an invaluable resource for those seeking to maximize their gains through leverage, farming and other novel deployments of borrowed assets. In light of the growth in this market, we, the Hundred Finance Team, are pleased to announce the launch of a new evolution in decentralized lending and borrowing, a unique protocol that combines the best aspects of our forebears in order to provide the broadest possible market a secure, liquid and community-driven borrowing and lending service.

Project History

While the last several months has seen the emergence of numerous projects, Hundred Finance owes its origins to an established protocol. In September of 2020, Percent Finance was launched as a 100% community distributed alternative to Compound Finance. Incorporating Chainlink oracles and focused on long-tail assets, Percent sought to create a lending platform with a fully democratic governance system that catered to the community and the assets they wished to see listed. Despite getting off to an amazing start, in November of the same year a protocol upgrade that included incorrect assumptions regarding interest rate models inadvertently locked several contracts permanently (for a full post-mortem, please refer to the original Medium article). In the aftermath of the incident, though Circle and Bitgo (issuers of the affected assets) were contacted in a bid to recover the locked funds using their blacklisting mechanisms, some users were left out-of-pocket. Despite this setback, the foundations upon which the protocol was launched remained strong and a wish to see all those whose funds were impacted made whole persisted. With that goal in mind, Hundred Finance has been designed to build on the strength of its predecessor’s community spirit, launching the protocol with a treasury that serves new users and old.

HND and its Tokenomics

Like Compound, its original inspiration, Hundred Finance will incorporate a governance token within its mechanics. In our case, this token is HND, which will be capable of being turned towards profit sharing or put to another use should community governance determine it. For example, it could be decided that protocol earnings be distributed to HND and HND-ETH stakers, or even partially earmarked for covering the losses of those whose funds were locked in the compromised Percent contract.

In designing the tokenomics for the HND token, we have combined a distribution method that incentivizes the growth of the protocol, while also acknowledging the users of Percent Finance. The genesis of the HND token will include a migration function made available to holders of the original Percent token (PCT). PCT tokens will be able to be migrated to HND on a 1:1 basis at launch, though there will be a year-long vesting schedule for 90% of the HND received.

The development team will use the 1M PCT currently held with ETH in a Balancer pool (with a combined value of approximately $250k) to seed a new HND-ETH Balancer V2 pool as a means of providing deep liquidity for those wishing to participate in the project. The additional HND that is minted and not assigned to migrated PCT (approximately 82.5M) will likewise be reserved for project initiatives, such as liquidity mining, development fees and protocol expenses. This portion of the total supply, however, will be emitted at a slow and controlled rate, limiting the number of circulating tokens in the protocol’s first year to a fraction of the maximum.

Market Incentives

Market incentives will be drastically different for Hundred when compared to Percent. At least initially, only stablecoin markets will be incentivized, and only on the supply side. Furthermore, stablecoins will have a collateral factor of 0%. This means that people will not be able to borrow against their stablecoins, so they will not be able to “fold” their position by borrowing and lending the same tokens repeatedly, an ability that can have a detrimental effect on the system. Instead, emphasis will be put on the protocol’s ability to provide stablecoins to people who wish to use their blue chip tokens as collateral, who will further benefit from higher collateral factors when compared with our competition.

We at Hundred Finance have determined that stablecoins are the lifeblood of the current cryptocurrency system. As the main use case for lending protocols such as Aave, Compound and Yearn has become the ability to deposit blue chip cryptocurrencies in order to borrow stables, we believe a protocol that specializes in incentivizing the depositing of stable coins will allow us to carve out a niche in a developing market. We intend carrying this vision forward and further innovating to ensure that we become a major player.

Conclusion: A Multichain Vision for Lending

Central to our plans to establish Hundred in the field of on-chain lending and borrowing, is the bridging of multiple chains to provide an integrated and efficient user experience. One thing that has become painfully clear over the last year is that Ethereum’s gas costs can place a major burden on users and even price out many from participation. Due to this point of friction and the rising popularity of sidechains or non-ETH chains, we are launching Hundred as a multi-chain protocol. Through this initiative we aim to reach as large and diverse a user base as possible, making out contracts and user interfaces available on Ethereum, Polygon, Binance Smart Chain, xDai and HECO. In striving to grow and cater to all, we believe that Hundred Finance will be able to make its mark as a major contributor to decentralized financial systems and see its value to cryptocurrency users grow in kind.

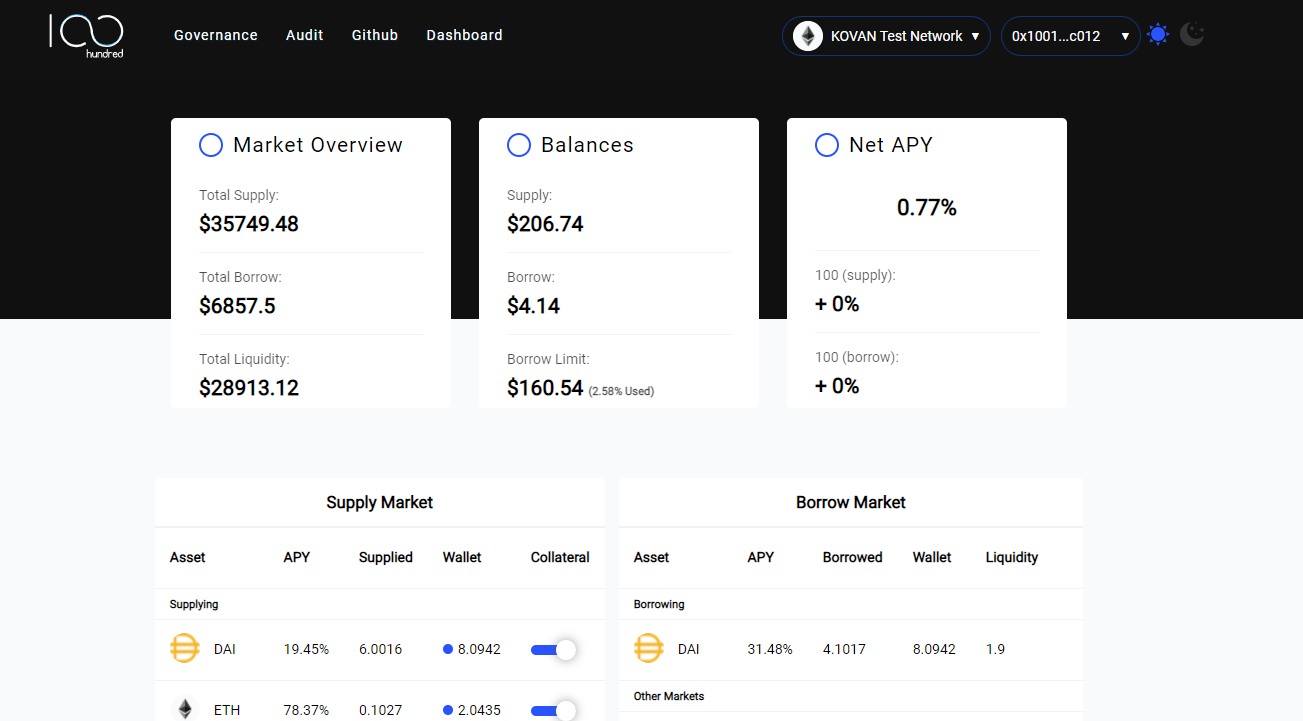

Incentivized Kovan testnet

The first step in our journey is a public test of the contracts using Kovan, which will be incentivized with HND tokens for participating addresses. You can help test by obtaining some Kovan ETH on the faucet, then swap for other tokens on Kovan Uniswap, and finally use the money markets at https://kovan.hundred.finance. Join us on our social channels below to provide feedback.

The Hundred Finance Team

Join us at

- Twitter Hundred Finance (@HundredFinance)

- Discord https://discord.gg/phK668J6dQ

- Telegram https://t.me/hundred_finance