Sep 27, 2021

Hundred Finance Initial Liquidity Incentives

On September 24th, 2021, Hundred Finance went multichain with the release of Arbitrum integration for its decentralized lending and borrowing platform. In order to encourage users to bridge their assets and experience a core element of DeFi infrastructure at a fraction of the transaction cost experienced on the Ethereum mainnet, we believe it is important to provide robust incentives that reward early adopters. In light of this, on 2021–09–28 we shall be beginning the first phase of our initial incentive program for those liquidity providers who move certain assets to Arbitrum using the token bridge and make them available for borrowing.

Stablecoin Incentive Program

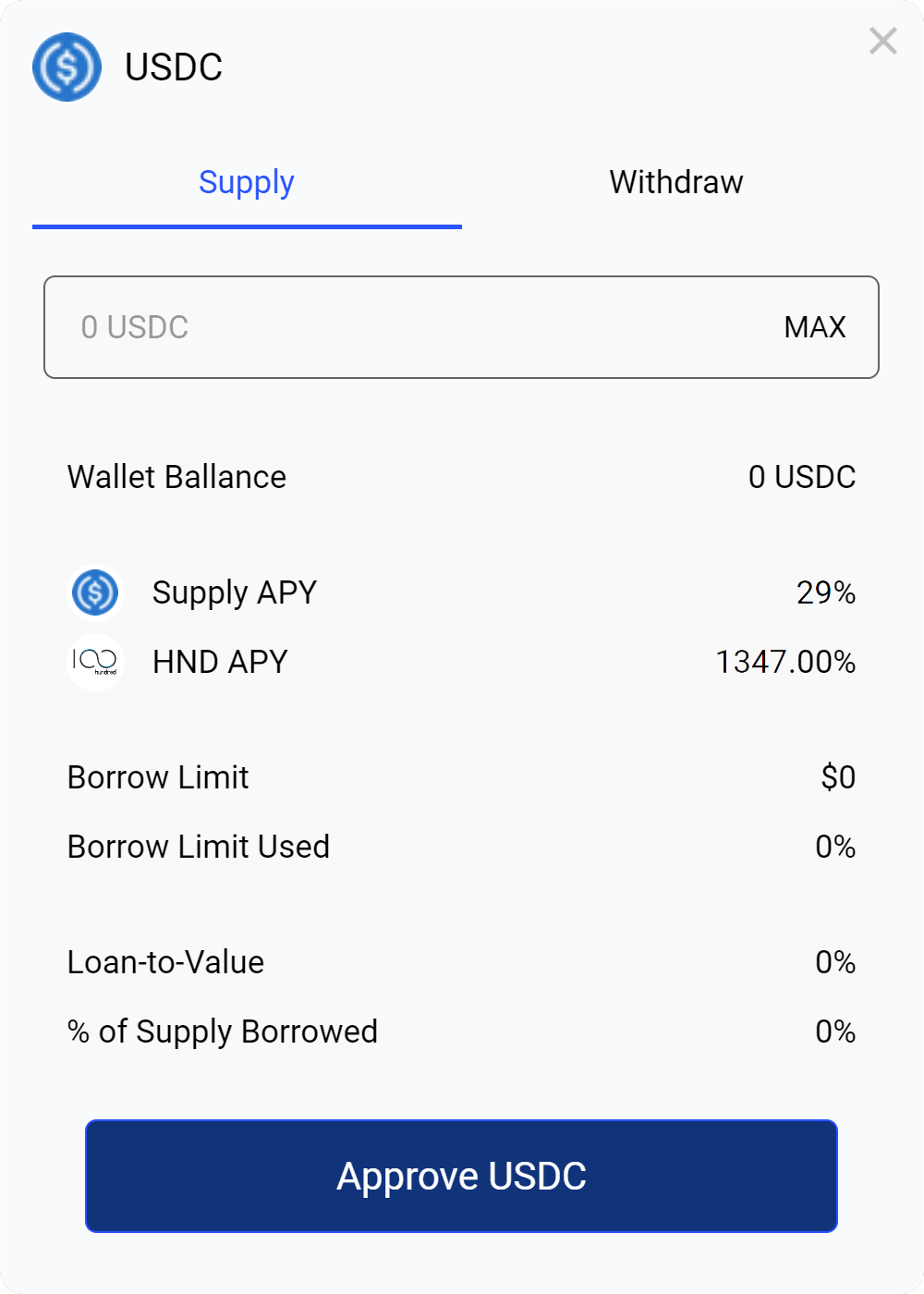

From approximately 2021–09–28 20:00 UTC, at Ethereum block 13316100, we shall be running an initial 4-week incentive program that will distribute 300,000 HND tokens to wallets that deposit either USDC or USDT into our Arbitrum pools. Split evenly across these two stablecoin types (150k per pool), HND will be accrued on a per block basis according to an account’s proportion of the total assets deposited in each pool. Once emissions have begun, the APYs will be visible by clicking on the asset in question on the Hundred Finance UI (APYs depicted below are demonstrative only).

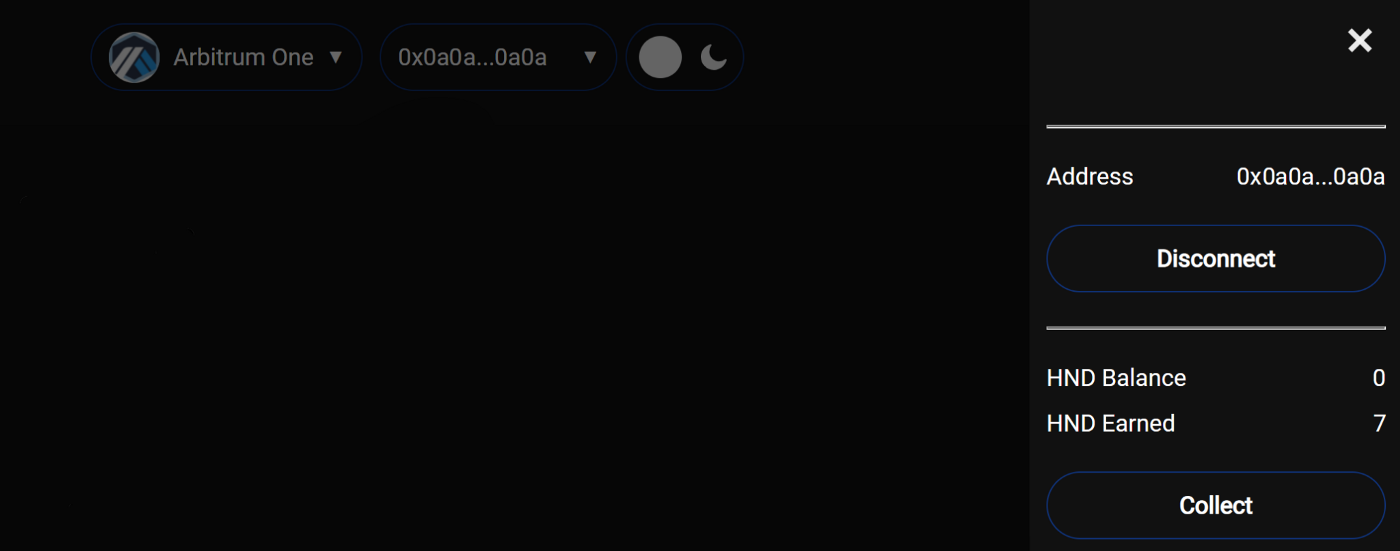

The claiming of assets as they accrue will be possible by clicking on the connected account’s wallet address in the site header and initiating a “Collect” transaction. This action will send any earned tokens to the relevant wallet.

The reasoning behind the relatively short and generous initial emission schedule is our desire to promote a rapid seeding of the protocol with liquidity able to facilitate thriving borrowing and lending markets. As both USDC and USDT are able to act as collateral on the platform, depositors will be granted access to the full array of assets available to be borrowed.

HND-ETH Dual Liquidity Incentive Program with DODO

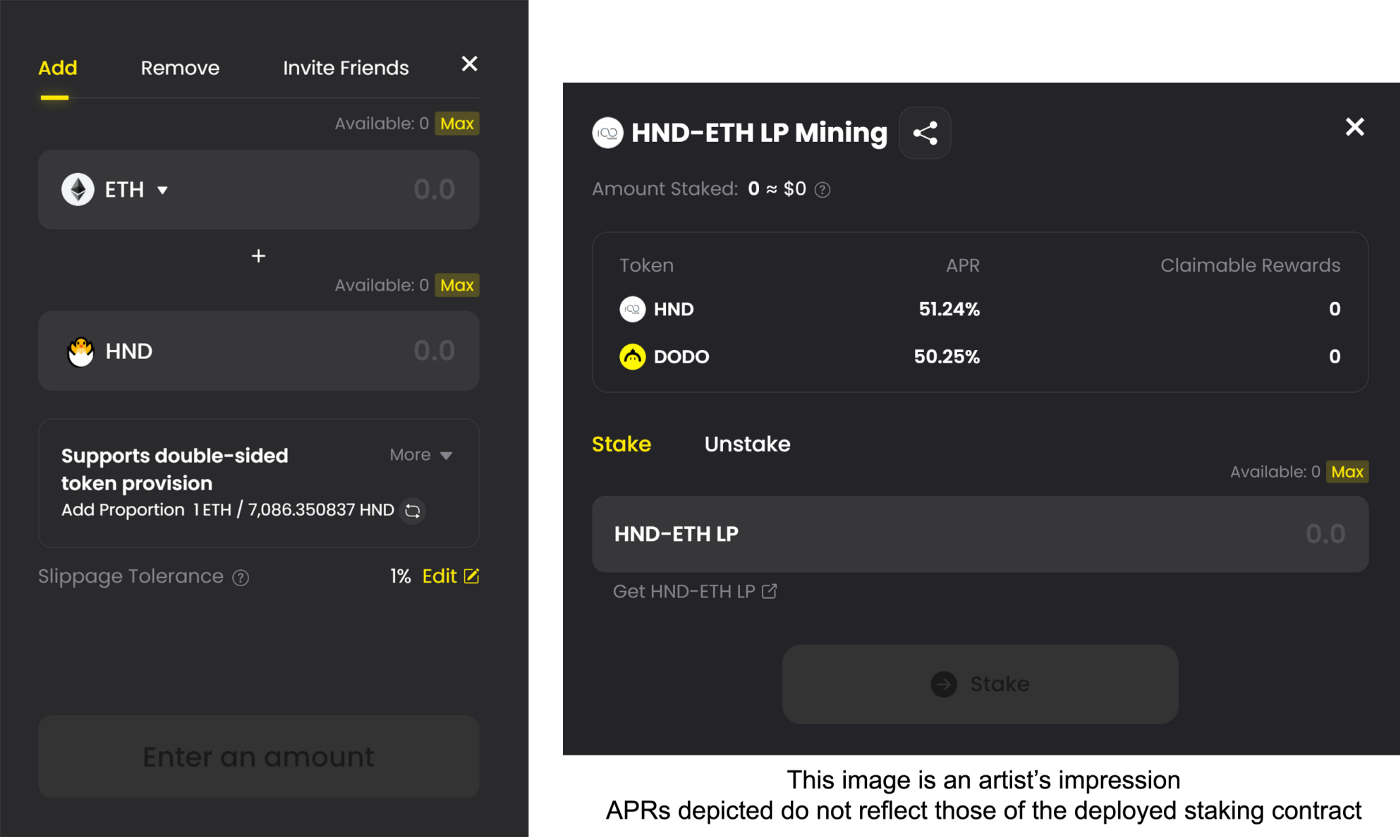

In addition to the stablecoin incentives being offered, we at Hundred Finance have also collaborated with DODO to offer dual rewards to liquidity providers who join their Arbitrum HND-ETH pool. A further 300,000 HND will be made available to liquidity miners over the course of 4 weeks, as well as 50,000 DODO. Like our stablecoin pools, these will reward participants based on their proportion of the pool’s added liquidity staked in the mining contract.

To be clear, once HND and ETH have been added to the pool on DODO using the link that follows, the liquidity tokens received must then be staked in the mining contract in order to accrue rewards. Failure to stake LP tokens will result in only the accumulation of trading fees and exposure to impermanent loss. Please ensure that tokens are correctly staked in order to enjoy the HND and DODO token rewards emitted.

Add liquidity to DODO: https://app.dodoex.io/liquidity?network=arbitrum&poolAddress=0x65e17c52128396443d4a9a61eacf0970f05f8a20

Stake liquidity tokens: https://app.dodoex.io/mining?network=arbitrum

Conclusion

We anticipate that these initial liquidity incentives will encourage our platform’s first wave of Arbitrum users to bridge their assets, who will then go on to spread word of Hundred Finance’s cross-chain provision of ChainLink-integrated, long-tail token markets. As the project progresses, distribution will be adjusted to maximize the value it adds to the protocol as we carefully seek to balance user acquisition with HND emission. In order to keep up to date with the latest news regarding our incentives programs, please be sure to join the project Discord or follow us on Twitter. It is through these social media platforms that we will be announcing the starting block for these first two programs, as well as those that follow.