Mar 12

Hundred Finance Launches Lendly White Labeling with veDAO

In a major step for Hundred Finance, we are excited to announce the launch, today, of a brand new revenue-generating product and partnership. Building on the creation of our special treasury lending market, Lendly, we have teamed up with veDAO, the project behind the $WEVE token, in the release of the first custom version of a whitelabel Lendly product.

Founded on the belief that ordinary investors deserve the opportunity to own a portion of the innovative new automated market maker (AMM) Solidly, veDAO is a “people’s cooperative” with the goal of supporting and empowering the Solidly ecosystem while simultaneously driving long-term value to the veDAO community. Hundred Finance’s partnership with veDAO will allow them to better achieve these ambitions through the use of their own special version of the Lendly application. In collateralizing rather than selling treasury-held assets and then borrowing against them on a Lendly market, veDAO will be able to better build on their successes and work more productively with their partners in bringing users to the developing veDAO ecosystem.

Inter-Project Incentives

To incentivize those who provide liquidity to the new Lendly market, the veDAO and Hundred Finance’s teams are collaborating in the provision of token rewards. veDAO themselves have already committed to making WEVE emissions available to suppliers of USDC to their version of Lendly, while the creation of the veDAO/WEVE deployment brings with it a new USDC gauge that can be voted for within the Lendly vote page. There, veHND holders will be able to have their say in where HND emissions devoted to Lendly on Fantom are directed. Using Lendly’s customized gauge contract, these rewards will then be automatically distributed to liquidity providers, with users receiving them pro rata, based on their portion of the total liquidity supplied to each gauge, the HND devoted to that gauge, and the length of time that they make their funds available.

This initiative not only serves the interests of the veDAO project but veHND-holders too. For providing the Lendly service, Hundred Finance will receive the 20% reserve rate (the “fee” generated by the spread between supply interest rates and borrow interest rates) on an ongoing basis for the provision of the market, as well as 2% of all external rewards. This is a model we intend building upon, seeing great potential in developing Lendly as a consistent revenue stream for the protocol.

Growing Partnerships

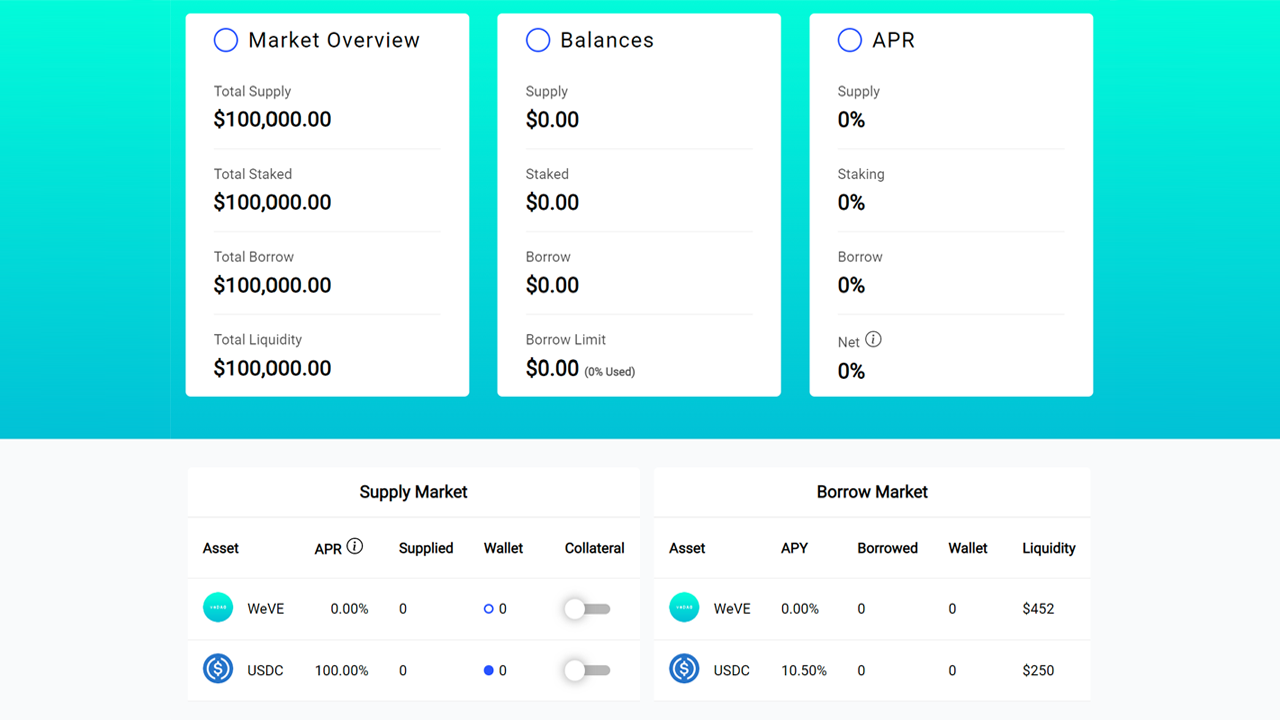

We have designed the Lendly application to support the addition of multiple project partnerships. As can be seen from the screenshot below, we envisage users with assets that they wish to make available visiting the site and selecting the project version of their choosing. They will then be able to deposit their assets based on their risk assessment of their intended use, the requirements of the team behind the project, and the rewards offered to those who supply liquidity for the project’s use. This will make just the Lendly main page an attractive destination in and of itself, as it gradually grows to accommodate a catalog of project-based incentivized lending opportunities.

Lendly’s Multichain Scope

While initially facilitated by the ability to use the Solidly DEX as an oracle solution, Lendly deployments will not be limited to the Fantom network. Owing to its focus on the collateralization of project assets by the projects themselves, other oracle solutions that satisfy the various teams with which we partner can be integrated following due diligence having been completed. This will allow Hundred Finance to strengthen its multichain mission, becoming a major player by facilitating the borrowing and lending of crypto by people and projects throughout the wider blockchain industry.

Conclusion

This first partnership born out of Lendly is without doubt one of the most exciting developments in Hundred Finance’s history. Collateralization of project funds provides a means of early-stage projects acquiring liquidity without the need to sell their own tokens, flipping capital acquisition from what is often perceived as a community negative activity into a community collaborative one. Moving forward we shall be continuing discussions with other interested parties, and developing relationships that will help this arm of Hundred Finance’s functionalities grow. Stay tuned for further releases in this vein, as we further empower the cryptocurrency sphere through innovations in borrowing and lending.