Apr 5

Hundred Finance Launches on Polygon

Today, we are pleased to announce the launch of the Hundred Finance dApp on the chain that arguably kicked-off the Ethereum scaling solution mania, Polygon! With over a billion reported transactions completed on the network to date and around 2.7 million monthly active users, this deployment will deliver Hundred Finance to one of the most thriving communities in the multichain DeFi ecosystem. We intend to complement this Layer 2 hub of decentralized financial tech not only by offering our usual low-cost lending services with market-leading APRs on supplied stablecoins, but also by integrating our new LayerZero-powered veHND mirroring solution and the most advanced version of the community-funded B.Protocol backstop technology built thus far.

Polygon: An Introduction

Polygon is a Layer 2 Ethereum scaling solution that enables developers to build user-friendly dApps with low-cost transactions secured by their modified proof-of-stake consensus mechanism. Considered a major player in Ethereum’s “internet of blockchains,” Polygon assists in the incorporation of existing networks by enabling communication between them. Rather than acting as a competitor to Ethereum, its builders see the network and its MATIC token as providing additional features and benefits relating to security, sovereignty and modularity, as well as user and developer experience.

Hundred Finance users now have access to the complete Polygon ecosystem simply by switching their browser wallet to the correct RPC settings and depositing enough MATIC into their Polygon account to pay for transaction fees. To carry out these tasks, simply visit hundred.finance and select Polygon from the network menu to the right, before then using either the official bridge or one such as Multichain to ensure the wallet is loaded. With literally hundreds of dApps already available on the platform, we are excited to play a role in introducing our community to the well-established and diverse world of Polygon.

LayerZero veHND Mirroring

In further exciting news, Hundred Finance’s Polygon launch will see the debut of the latest iteration of our LayerZero-based mirrored veHND token system. For those who are unaware, Layer Zero is a cross-chain messaging solution that provides a “third way” in the provision of security within the multi-chain ecosystem.

Currently, the two most prevalent approaches to handling the validation of cross-chain transactions entail either sacrificing security for the sake of cost (using a “middle chain” vulnerable to consensus attacks to receive, validate, and forward messages) or putting a huge burden on the financial resources of projects (on-chain validation of data against the block headers using light nodes can cost tens of millions of dollars a day). Upending this dichotomy, LayerZero has broken new ground by creating Ultra Light Nodes (ULN) that combine the security of a light node with the cost-effectiveness of middle chains. This is achieved by performing the same validation as an on-chain light node but streaming block headers on demand.

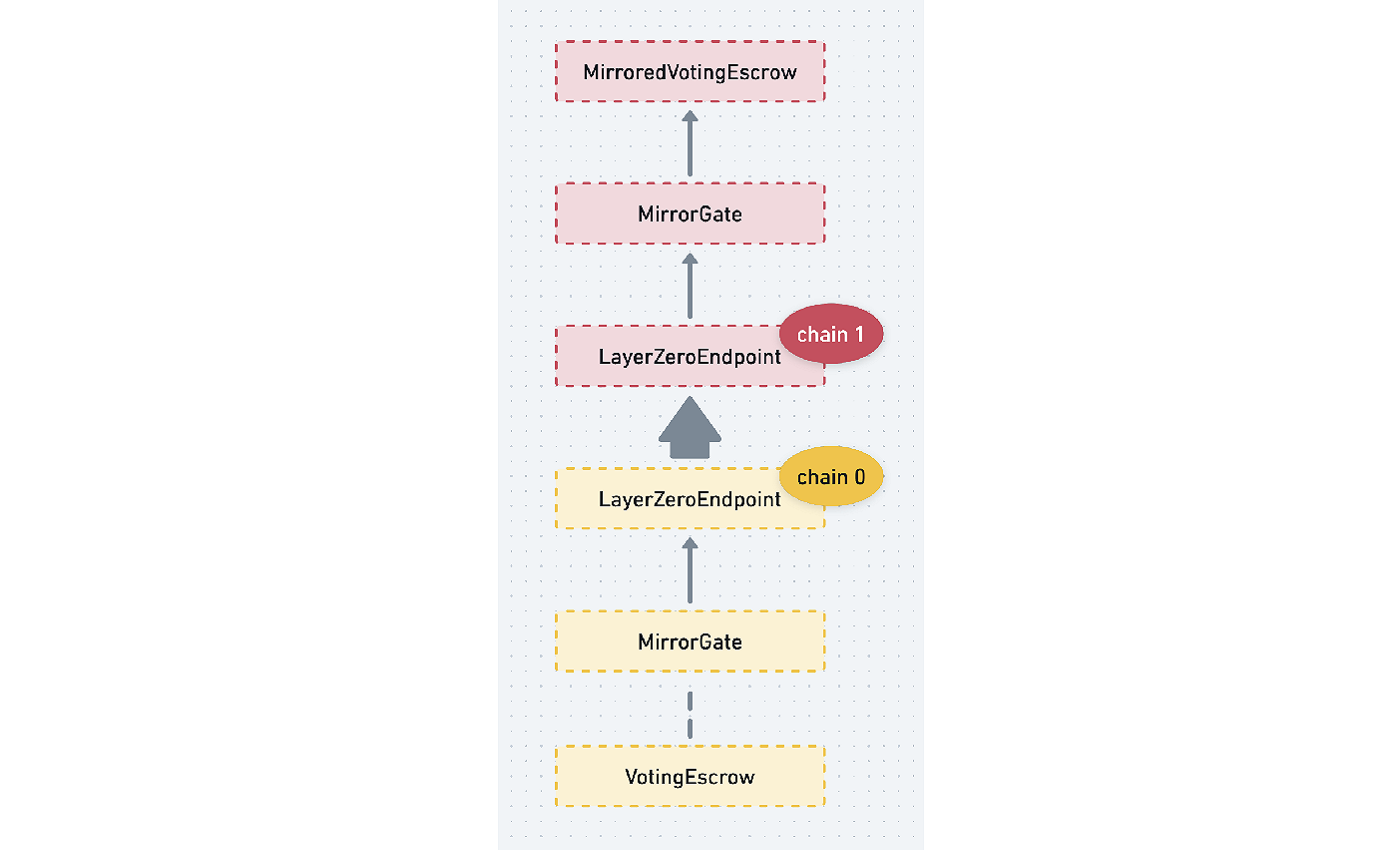

Hundred Finance uses LayerZero’s open relayer system to facilitate the passing of messages between two MirrorGates. When a user carries out a mirrorLock of a veHND position on an integrated chain, the mirrorGate contract is responsible for validating and formatting the message before calling the LayerZero endpoint on Chain 0. This LayerZero endpoint then takes the verified message and, after some time, calls the Chain 1 LayerZero endpoint to have the message passed to the equivalent MirrorGate. With the lock data securely passed between the endpoints and validated by the MirrorGate contracts, this information can then be applied to the user account and their current mveHND token benefits received.

Should Hundred Finance broaden our use of LayerZero in the future, we would have the benefit of one single interface and code base for all cross-chain pairs. All it would take to implement new mirrorGate contracts on new chains would be the creation of their own send and receive functions. While we are not yet wedded to a single messaging solution, our integration of LayerZero technology provides a valuable glimpse at the promise of cross-chain messaging solutions like LayerZero, Multichain and others. A promise that we hope to soon see be met by our delivery of a revolution in cross-chain borrowing and lending.

B.Protocol on Hundred Finance: Polygon

In addition to introducing Hundred Finance and LayerZero technology to a new chain, our Polygon launch also introduces a new innovation in the B.Protocol backstop technology we use to socialize our liquidation process. Up until now, user-provided stablecoins made available to fund liquidations have sat dormant unless market conditions generated liquidation opportunities for them. This dormancy created the ongoing presence of capital inefficiency. Now, however, instead of assets added to the backstop pools being segregated from those made available to borrowers, deposits will first be automatically added to the relevant hTOKEN contract (in which they will earn supply-side interest), before then being sent to the new-and-improved backstop AMM.

This change in the mechanism behind Hundred Finance’s Polygon version of the B.Protocol backstop essentially makes its three pools act much like those used to reward hTOKEN stakers. When adding funds to the backstop (either USDC. DAI and USDT), suppliers send their coins to a helper contact that first deposits them in the hTOKEN lending pool, then moves them on to the bhTOKEN contract (representative of their backstop-enabled share of the hTOKEN pool) before finally adding them to the backstop gauge and sending back the relevant gauge token (bhUSDC-Gauge, for example). As this means the backstop is effectively a gauge, it also allows our users to influence which backstop pool receives what proportion of the HND emissions dedicated to the backstops. Just as they can for regular gauges, veHND token holders can vote on where the distribution of HND emissions are directed from among the three assets incorporated with the system.

The Polygon (B.Protocol) page in the voting UI can be used to control which of the backstop gauges receive what proportion of 20% of the HND emitted on Polygon every epoch. Crucially this means we no longer have to incentivize backstop providers separately, this 20% incentivizes both money market liquidity and backstop provision at the same time. This process further increases the utility of veHND, as it allows users to provide liquidity for liquidations in the assets they favor during periods of market volatility, further rewarding active participation and, in a way, “gamifying” DeFi.

Polygon Liquidity Mining 2.0 Incentive Program

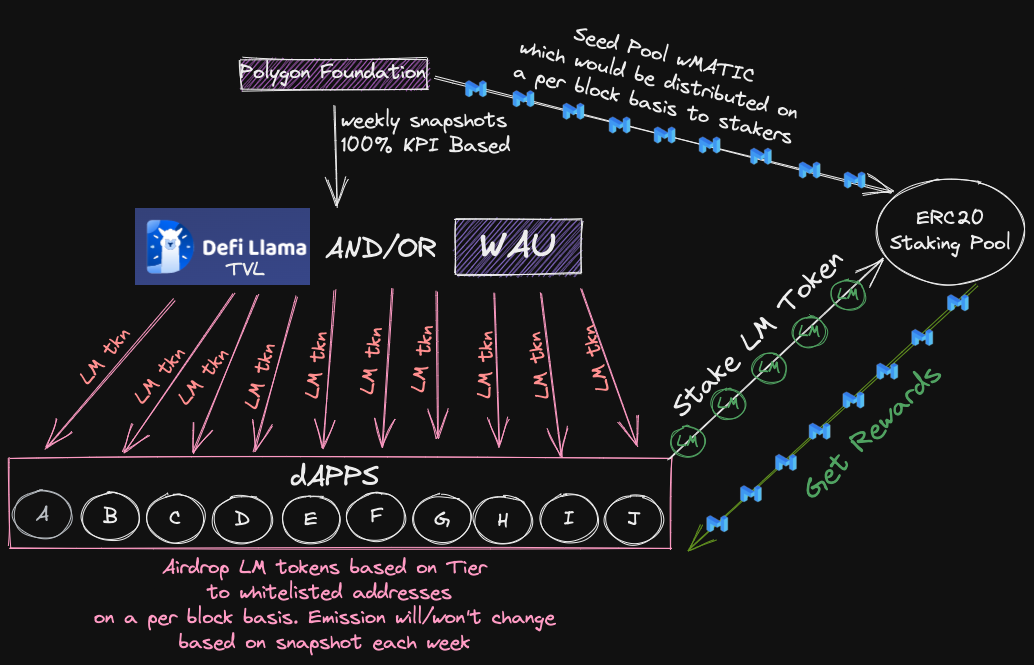

In addition to launching Hundred Finance on Polygon, we shall also be submitting an application to join the second phase of their liquidity mining program. This generous program is designed to reward those protocols that consistently contribute to the total value locked (TVL) and weighted active users (WAU) on the network. Liquidity mining rewards would be emitted over a six-month period, contributing wMATIC to the Hundred Finance treasury and thus being made available to aid in our growth as a contributor to the Polygon ecosystem.

Conclusion

We on the Hundred Finance Team are looking forward to welcoming Polygon users to the community as well as delivering LayerZero cross-chain messaging and socialized liquidations incorporated with veTOKEN technology to the wider DeFi ecosystem. These are exciting times for our protocol as we push forward and broaden our availability across the multichain cryptocurrency landscape.