Mar 14

Hundred Finance: Mirroring Monday

Today, we are pleased to announce Hundred Finance’s first Mirroring event!

A mirroring event is a big deal for any multichain DeFi protocol because it increases integration and thus improves capital efficiency. Today’s Mirroring Monday event allows, for the first time, users of the Hundred Finance protocol to see their total veHND-acquired balances applied (or mirrored) on the compatible versions of the dApp with which we have integrated mirrored veHND (mveHND). With these compatible versions now able to see the sum of all locked veHND across chains, APR boosts reflect the user’s total balance accumulated across all deployments.

So far, the chains to which aggregate veHND can be applied include Moonriver, Gnosis and Optimism, with the remaining active chains (Arbitrum, Fantom and Harmony) to be incorporated gradually. This will allow a smooth transition to what we’ve long been striving for: a fully-integrated multichain network.

The Mirroring Process

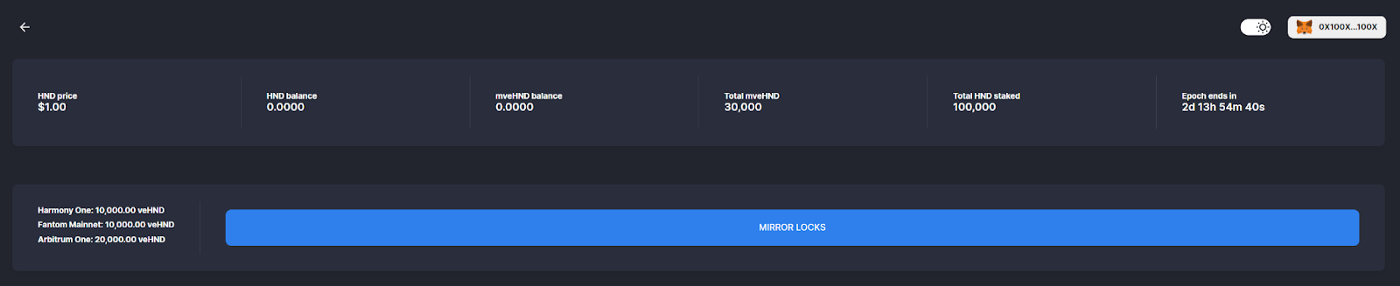

In order to carry out our first mirroring event, the primary task was the creation of a way to securely calculate the balances of all veHND holders and then take those totals and make them readable by the compatible versions of the dApp. We did this by snapshotting balances last week across all chains, before then generating a merkle-based contract that could be deployed on Moonriver, Gnosis and Optimism, and be read by the relevant versions of Hundred Finance. Users who have veHND balances will now find when they visit the vote page of either of these three chains, that if their veHND is on a chain other than the one they’re connected with then they can “Mirror Locks,” the process of applying their total balances locally.

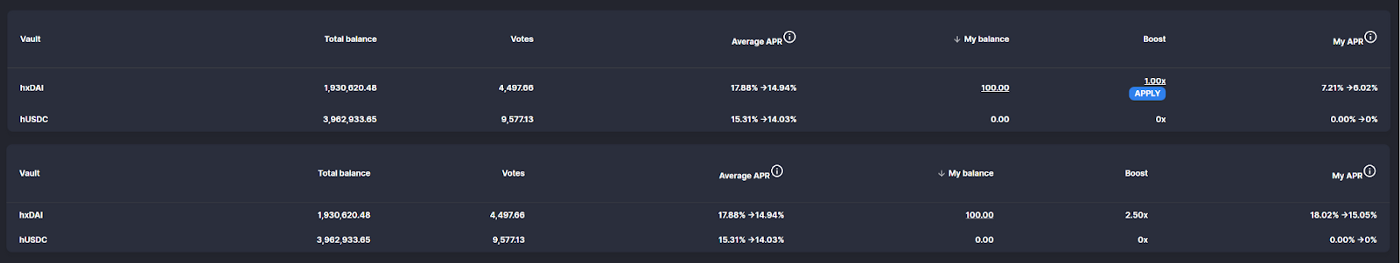

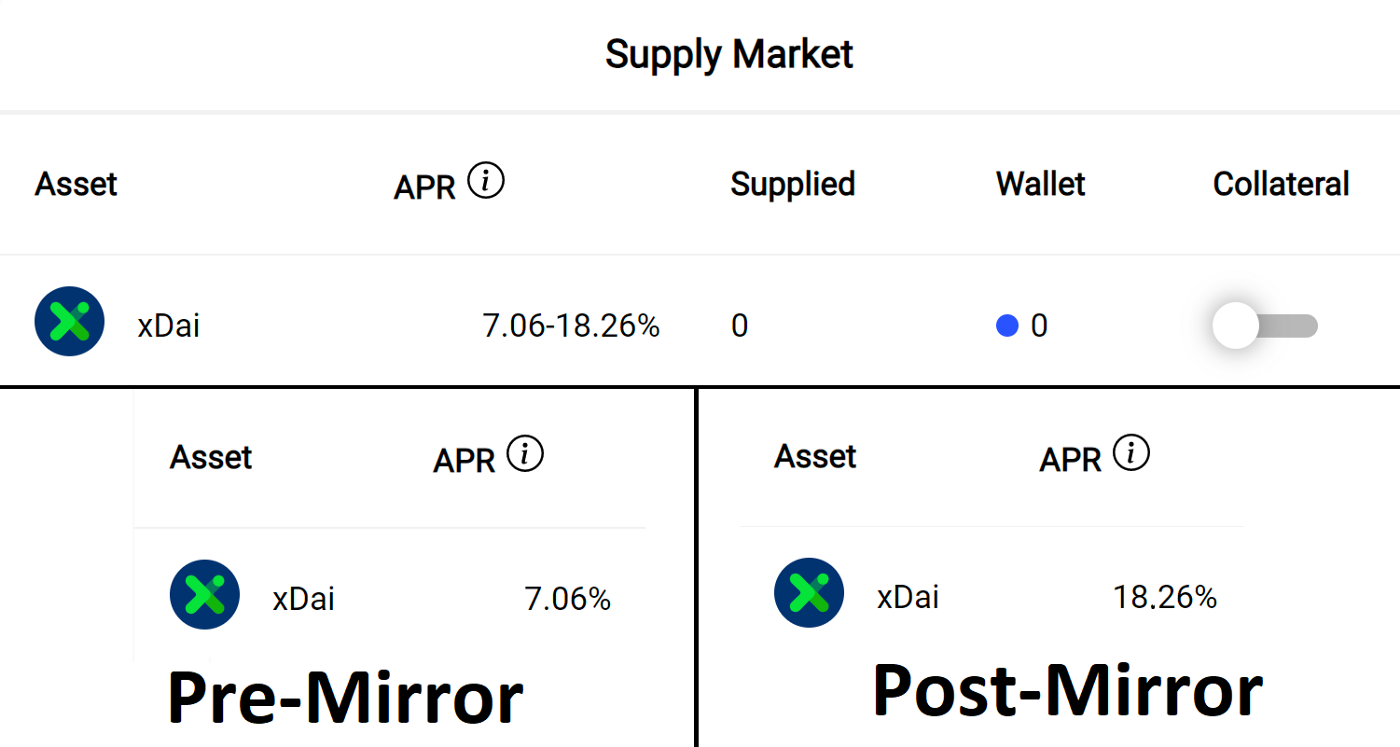

Once a user’s locks have been mirrored, assuming that the account has a balance deposited in one of the gauge staking contracts, they will then be able to apply their newly enabled mveHND and receive a more powerful boost. As can be seen from the screenshot below, if enough veHND is held on alternative chains then an account receiving the minimum boost pre-mirror could see it instantly skyrocket.

With this boost in place, their APR likewise rises, as does their ability to accumulate further HND. This is an incredibly valuable upgrade, as it effectively levels the playing field for those who may have locked a significant amount of HND on a chain that have proved to be less active or that has seen its Hundred Finance deployment favor a particular stablecoin that they do not wish to hold.

Conclusion

Mirrored veHND represents a significant improvement for the protocol. While we await the completion of development on cross-chain messaging, mirroring events provide an incredibly useful stopgap and allow us to demonstrate the quality of these innovations. We are therefore intending to regularly repeat these mirroring events, so that, going forward, our users can be sure that they need not fear locking their HND to a particular chain, for as the network grows so will the reach of their power within it.