Nov 4, 2021

Hundred on Fantom: HND Token Mining Opportunities

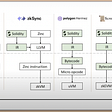

With Hundred Finance now live on Fantom Opera, we are happy to be able to announce our upcoming token emission plans for our new deployment. As with Arbitrum, HND is being released using two incentivized liquidity programs.

Stablecoin Incentive Program

From approximately 2021–11–06 at 14:00 UTC, we shall begin an initial 4-week incentive program that will distribute 200,000 HND tokens to wallets that deposit either USDC or USDT into our Fantom pools. Split evenly across these two stablecoin types (100k per pool), HND will be accrued on a per block basis according to an account’s proportion of the total assets deposited in each pool. Once emissions have begun, the APYs will be visible by clicking on the asset in question on the Hundred Finance UI (APYs depicted below are demonstrative only).

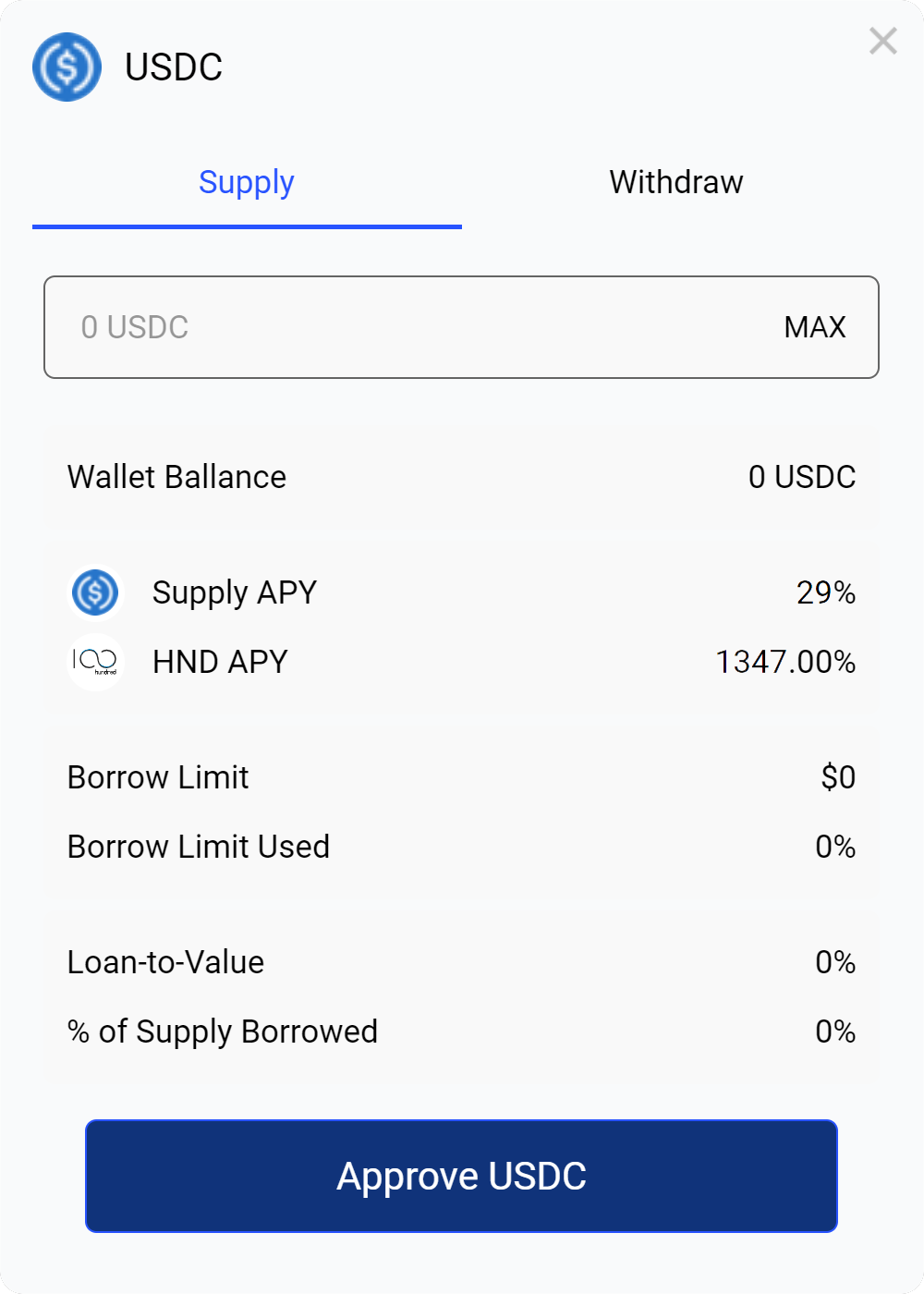

The claiming of assets as they accrue will be possible by clicking on the connected account’s wallet address in the site header and initiating a “Collect” transaction. This action will send any earned tokens to the relevant wallet.

HND-BEETS Dual Liquidity Incentive Program with Beethoven X

In addition to the stablecoin incentives being offered, we have also collaborated with Beethoven X DEX to offer dual rewards to liquidity providers who join their HND-USDC-wFTM 60–20–20 weighted pool. 100,000 HND will be made available to liquidity miners over the course of an initial 4 weeks, as well as approximately 32,000 BEETS. Like our stablecoin pools, these will reward participants based on their proportion of the pool’s added liquidity staked in the mining contract. To clarify the process for adding liquidity to this pool, we’ve created the tutorial below.

Beethoven X Liquidity Provision Tutorial

In this guide we will explain how to provide liquidity to Beethoven X pools in order to earn HND and BEETS dual rewards, as well as the pool’s swap fees.

What is Beethoven X?

Built on Balancer V2, Beethoven X is the first next-generation AMM protocol on Fantom. In allowing weighted investment pools, it acts like an index fund but with the addition of fee collection from trades that rebalance your.

Each pool can contain up to 8 different tokens, where each token is assigned a weight defining what fraction of the pool is made up by each asset. Beethoven X provides a Uniswap-style trading experience, allowing for trades from one token to another. Behind the scenes, the Smart Order Router (SOR) intelligently sources liquidity from multiple pools so as to automatically provide the best available price from all available pools.

Protocol fees are distributed to liquidity stakers, so by providing liquidity to the pools users stand to gain in fees as well as token farming distributions.

What do you need to add liquidity on Beethoven X?

- Pool tokens on the Fantom Opera network

- FTM to pay for gas fees

- A Web3 wallet (MetaMask, for example)

How do I get tokens to the Fantom Opera network?

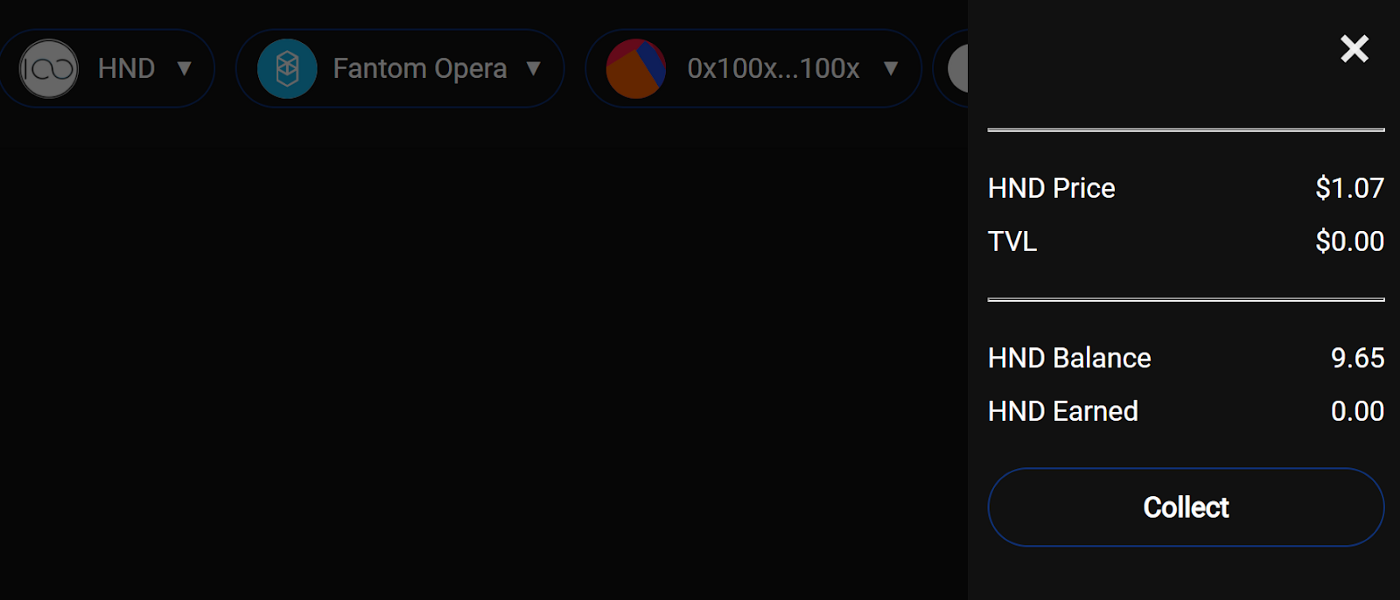

Eligible tokens can be bridged to Fantom using a dApp such as AnySwap. Once bridging is carried out, Fantom’s native token, FTM, will provide the equivalent functionality of ETH, such as paying for the gas involved in carrying out transactions.

Selecting the Fantom Opera network in the AnySwap header also has the advantage of configuring a user’s Web3 wallet with the necessary RPC settings to use the network. The first time an attempt is made to switch to a different network by pressing the “ETH mainnet” button in the top-right of the screen, what will follow is a prompt to load the correct network settings. After this is done it is simply a matter of switching to the desired network now that they have been set.

Bridging tokens from mainnet to Fantom entails ETH fees as well as an AnySwap fee and some modest slippage. As such, it is important to carry out the transaction while ensuring that current gas fees and the output is of an acceptable value. Furthermore, it is necessary to take into account the time needed to complete the transaction, usually somewhere between 10–30mins (any queries regarding delays should be directed towards the AnySwap team.

Where do I find the HND pool and how do I add liquidity?

Once on Fantom Opera, the first thing to do is navigate to the Beethoven X website’s Invest portion of the application. Here can be found the list of all the current pools created on the platform, as well as information including the tokens that make up each, the value locked, the 24 hour volume and the APR they pool receives. This APR is a result of the BEETS tokens each pool receives combined with the average swap fees the pool has been receiving over the previous 24 hours. The BEETS portion is calculated as an estimate based on the current emission rate and value of the BEETS token.

The HND incentivized pool, in keeping with Beethoven X’s musical theme and in reference to the BEETS and HND rewards it will emit, is called “When Two become One (Hundred). It can be found under the Community Investment Pools section or by navigating to the following link.

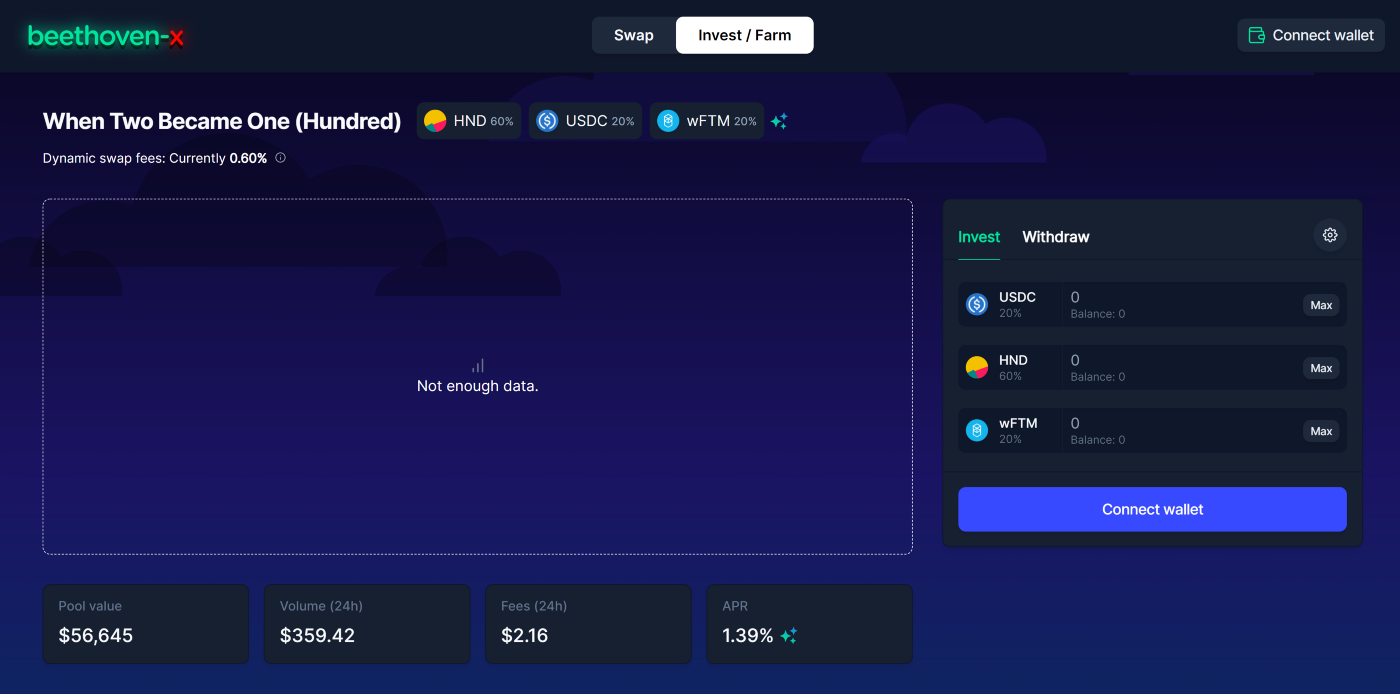

To the right of the pool’s name on the Invest/Farm page are displayed the tokens it contains, in addition to what proportion of the pool’s total value these tokens comprise. Below this is the swap fee, in the HND pool’s case 0.6%, a chart that depicts the pool’s growth and then the pool’s primary stats.

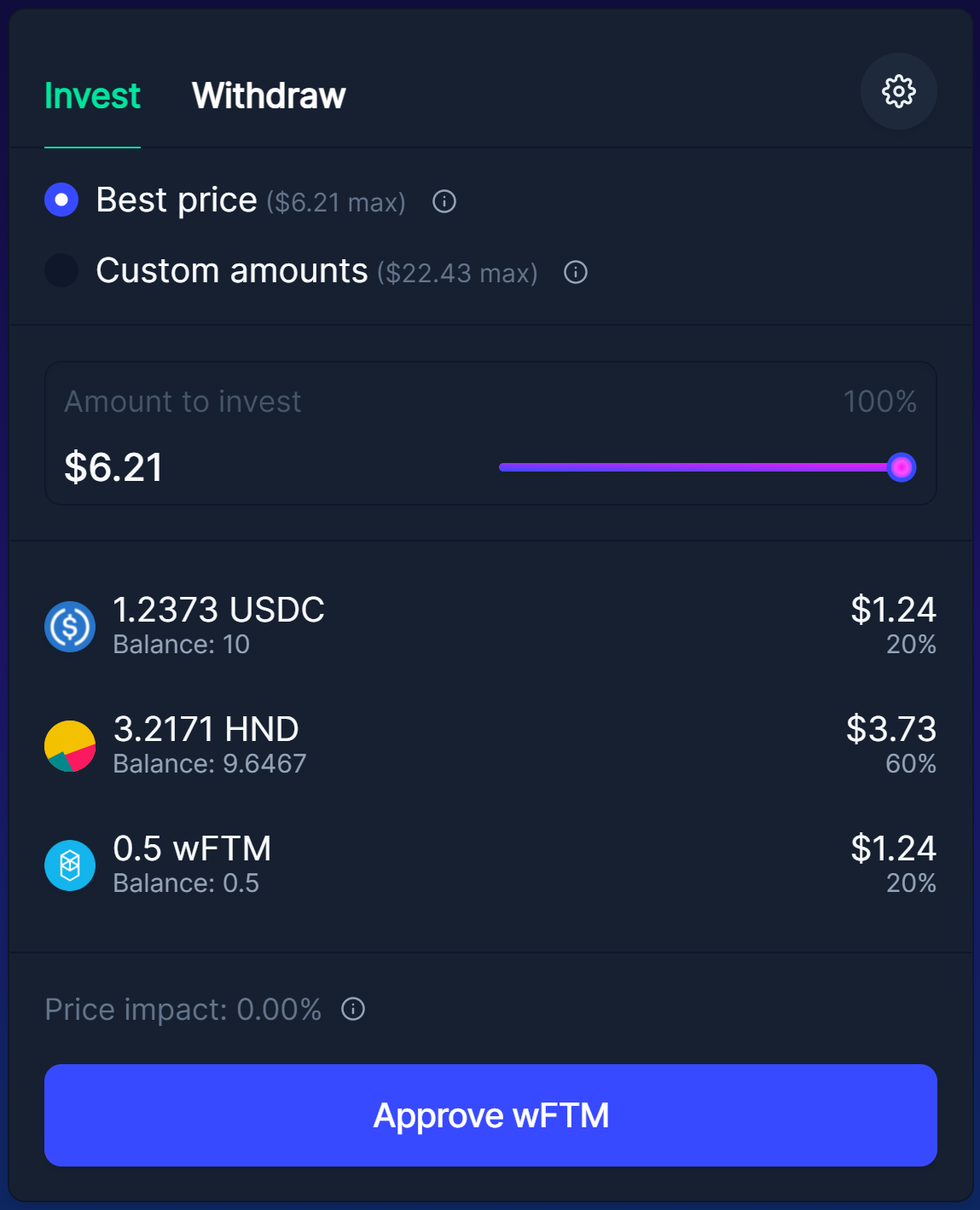

To add assets to the pool there are two options. In either case, however, it will be necessary to approve the tokens that will be deposited so that they’re able to interact with the pool contract.

Once all the necessary tokens are approved, it is necessary to choose from one of two approaches to adding assets.

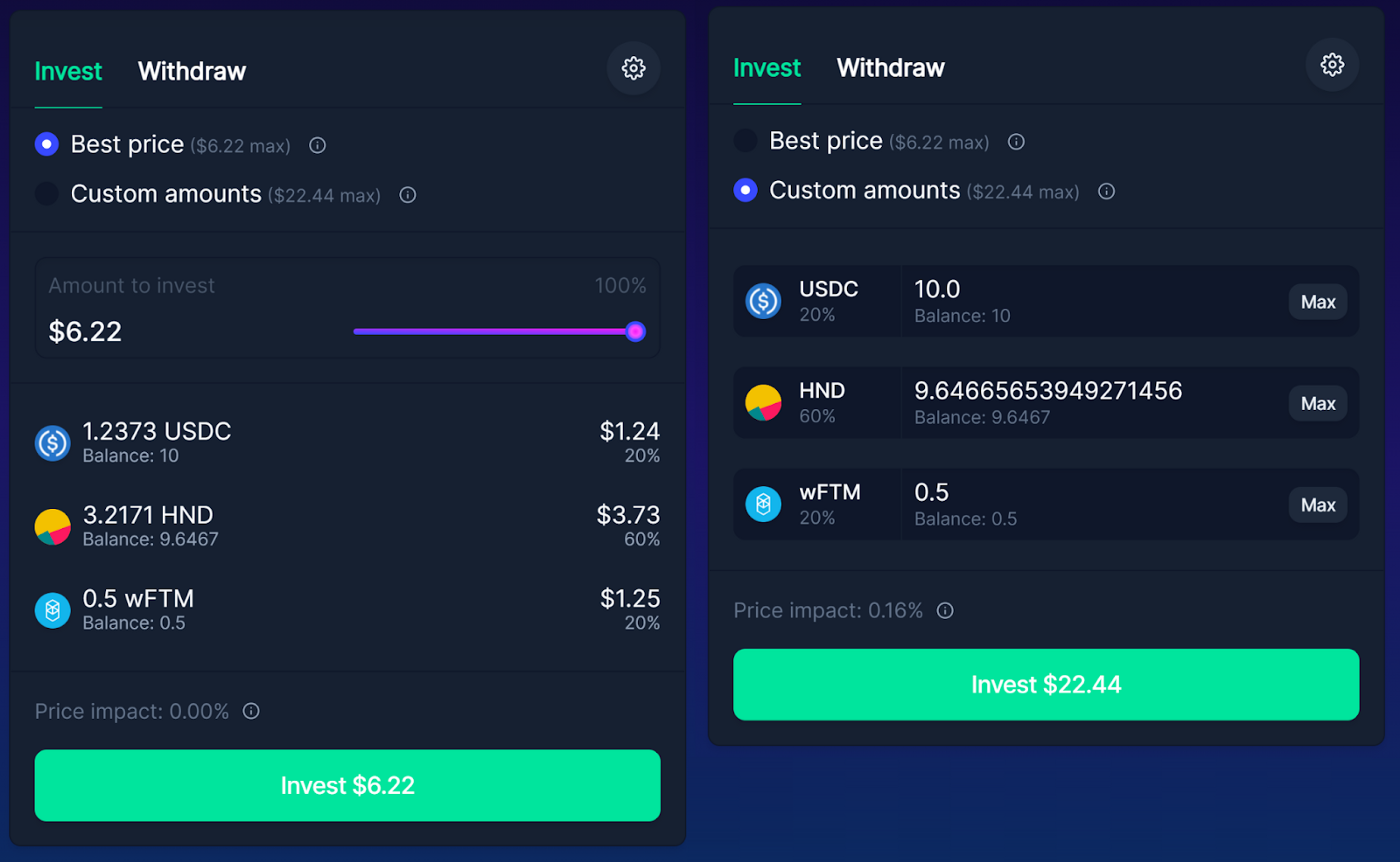

Best Price

Best price will only add tokens up to the point that the pool’s ratios can be met by the assets available to be deposited. If you’re short of USDC, for example, you will add less HND and wFTM as a result, as otherwise the proportion of each would be misweighted. To initiate the deposit it is simply a matter of pressing Invest and initiating the transaction on the Web3 wallet.

Custom Amounts

The second approach entails custom amounts to maximize the value added to the pool. Bear in mind, however, that heavy slippage may be incurred when adding assets in proportions that do not match the pool’s or when depositing large amounts as the act of depositing will have a price impact. In order to counter this, purchasing the assets that fall below the required amount can be easily done at a DEX on Fantom or even on the Ethereum mainnet to then be bridged across.

Whatever the method, pressing the Invest button will result in the transaction being sent to the browser’s Web3 wallet for approval and the funds added.

Deposit your BPT tokens

When you deposit into a Beethoven X pool you receive BPT tokens as a proportional representation of your share. It is these tokens that are then staked in a separate contract in order to accrue HND and BEETS dual rewards.

Once this contract is live, a Farm tab will appear within the pool UI and BPT tokens can be properly staked. DO NOT forget this step as otherwise swap fees will be the only reward for the provision of liquidity.

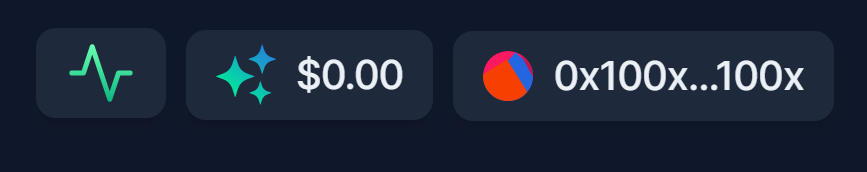

Congratulations! With USDC, HND and wFTM in the pool you are now earning swap fees and will be eligible BEETS and HND payouts once these are activated. Collecting these rewards can be done at any time and using the Beethoven X UI by clicking on the star button that depicts the value of the accrued rewards and opens a window from which a Harvest transaction can be submitted.

Now all you need to do is wait while you gather HND and BEETS tokens and build up your ability to have your voice heard as a governance participant!