Hundred Finance

Search…

Core Protocol

Protocol Governance

Developers

Community

HND Staking

HND token staking is being gradually rolled out for the protocol, with the intention that it will eventually be available for all deployments. Currently, it has been implemented on Arbitrum and Fantom Opera.

veHND Staking System

Hundred Finance has based its staking system on the veCRV model created by Curve Finance, which we have adapted to use the veHND token (veHND stands for vote-escrowed HND). The veHND model is designed to incentivize liquidity provision while simultaneously preparing users for participation in wider governance activities.

The first step for those wishing to participate in HND staking is visiting vote.hundred.finance. This is the doorway to the vote-escrow user interface that will play a major role in managing Hundred Finance going forward.

The splash page for the staking UI

In order to access the staking UI (created by SharedTools), users simply need to connect their browser wallet using the correct network settings. They will then find themselves presented with the following interface:

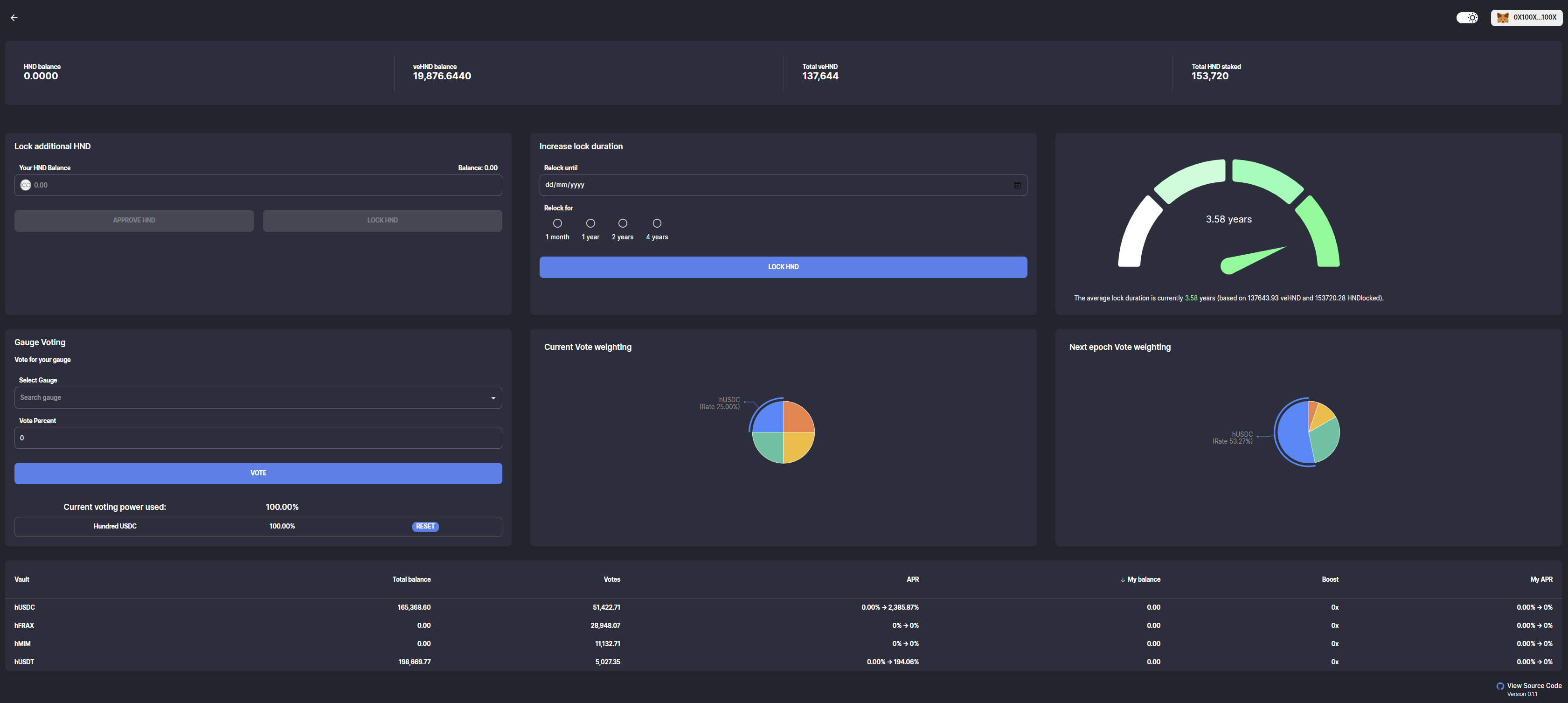

The HND staking UI

One of the main HND incentives is its ability to be used to boost an account's rewards when providing liquidity to the platform. The staking UI allows the vote locking of HND in order to receive voting power and APR boosts. How voting power is used by veHND holders is what determines which assets receive what proportion of weekly HND emissions, while the number of veHND an account possesses relative to their share of the liquidity in the farming contract they are using determines their boost.

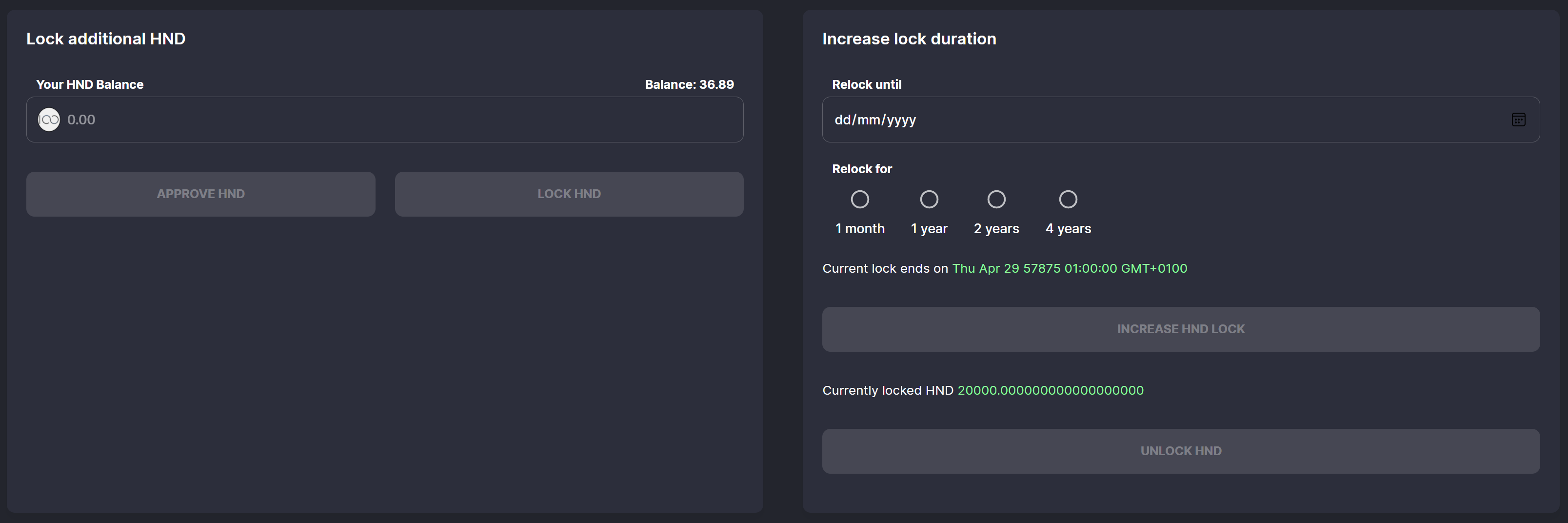

HND tokens can be staked for a period of time up to four years, during which they are locked within the protocol. Staking/locking HND in the vote-escrow contract results in the account receiving non-transferable veHND tokens in return, with the amount received a product of both the number of HND staked and the length of the stake.

Note: An account's veHND balance will decrease over time, eventually reaching zero. Once an account's veHND balance has reached zero it indicates that its staked HND are now unlocked and can be withdrawn.

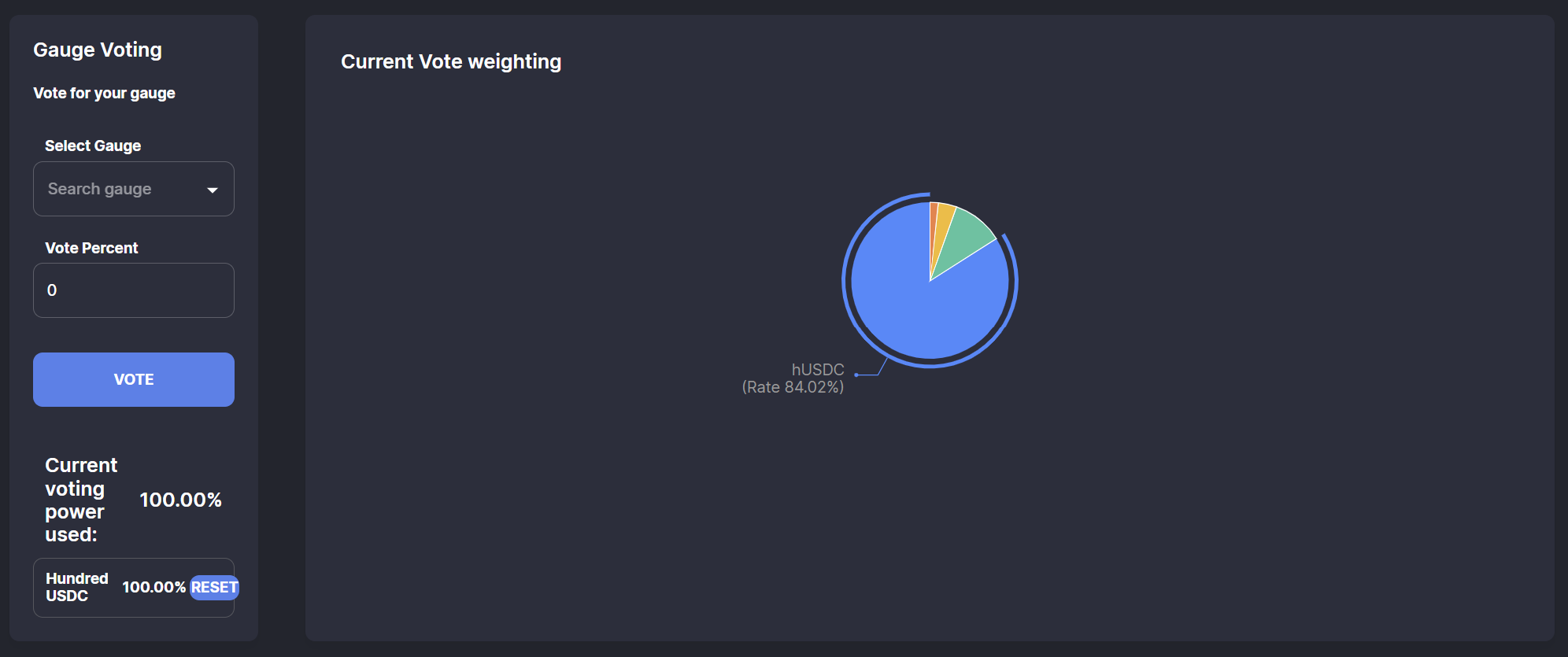

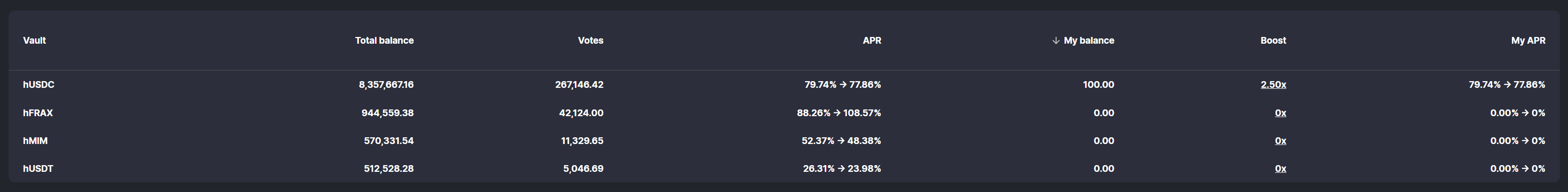

Gauge Voting

On receiving veHND tokens, an account may then choose to vote using the gauge system. Gauge voting is what determines how HND emissions are released each week. A fixed number of HND are distributed based on the proportion of vote weight that asset's gauge has received, with all assets eligible to receive HND emissions on each chain-based deployment having their own gauge.

The pie chart above indicates that the hUSDC farm, for example, receives 84.02% of HND emissions for that week

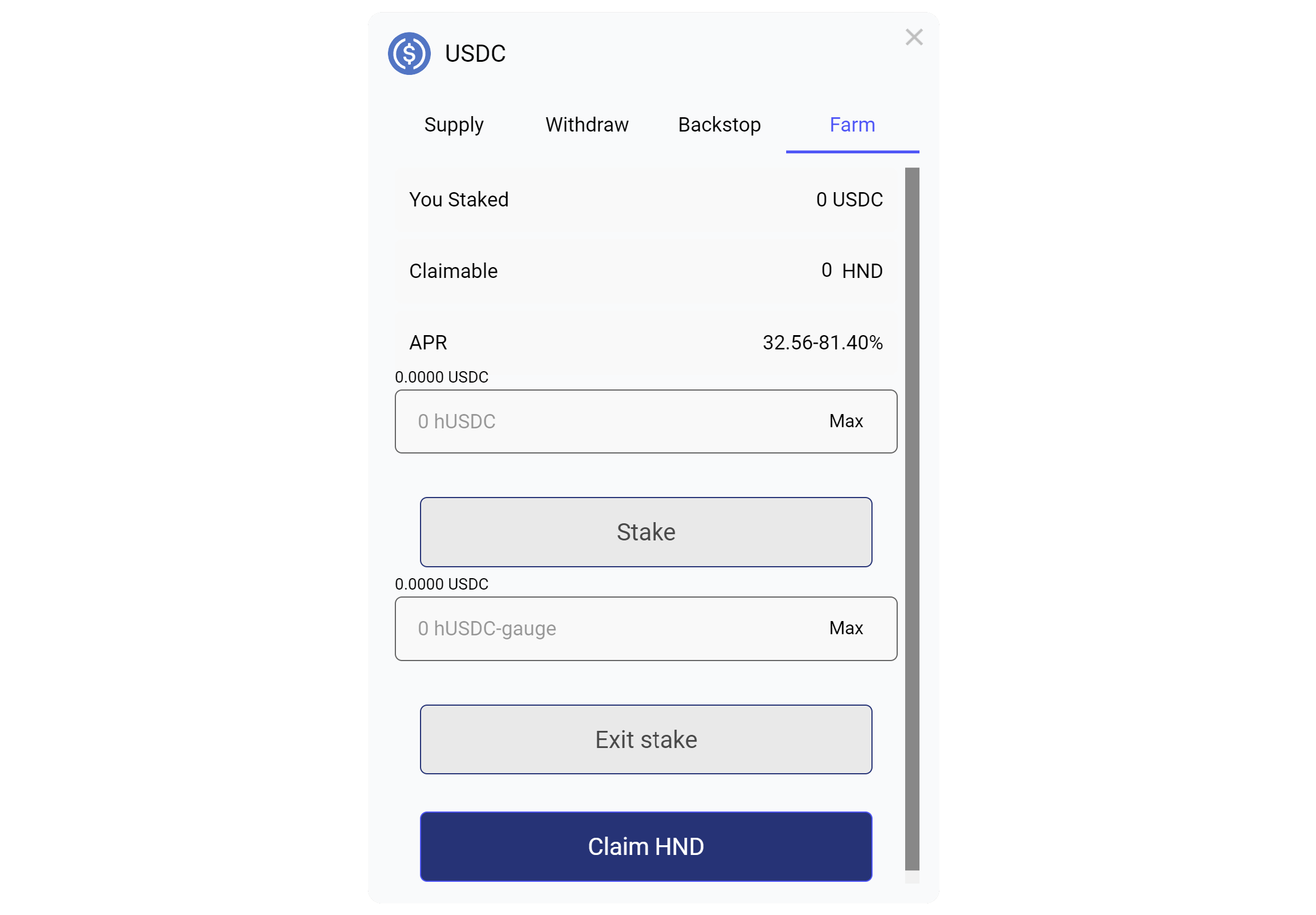

If you have staked HND then it makes economic sense to use your vote weight to grant emissions to the gauges of the assets you yourself intend depositing into the protocol. Once an asset, USDC for example, has been deposited and hUSDC received, these hUSDC tokens can then be staked in a farming contract using the regular hundred.finance UI to receive a cut of the HND assigned to that gauge.

The distribution of HND across gauges is updated on a weekly basis, though votes made by an account will remain in place unless altered by the account holder. There is also a 10-day cooldown period on vote transactions.

The gauges that are available (and thus which assets can be used to receive HND emissions) is currently limited to those implemented by the team, though subsequently, once enacted, governance will play the core role is gauge creation and HND allocation. In addition, as each chain will initially have its own gauge system deployed, voting on one chain will not impact how HND are distributed on another. This, combined with the cooldown, encourages the development of an environment of tactical voting and liquidity assignment that rewards attentiveness to the protocol.

Staking Boosts

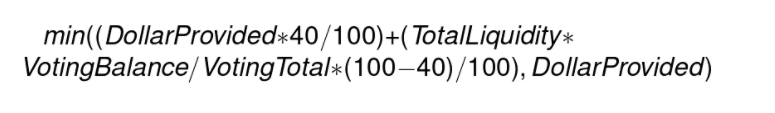

Staking also grants accounts the potential to receive boosted APRs on hTOKENs used to farm HND. This boost can be anything up to 2.5x depending on vote distribution across gauges and the composition of the farming contract (total liqudity, an accounts portion of it and their relative veHND holdings).

Voting power applies to all gauges but may produce different boosts based on how much liquidity is provided and how much total liquidity the pool contains. In order to provide clarity for users, on adding hTOKENs to a farming contract the staking UI will display their current boost, while mouse hovering over this figure will display the number of additional veHND that needs to be acquired in order to attain the maximum boost.

The variable boost available means that each farming contract also possess a variable APR. Accounts that have deposited hTOKENs but possess no veHND receive the lowest figure in the rand and those that have deposited hTOKENs and attained the maximum boost receive the highest. If an account wishes to increase their APR up the maximum while all other conditions remain the same, it is necessary to stake further HND or increase the length of time they are locked.

Formula for calculating boost

Note: It is necessary to interact with the farming contract after increasing one's supply of veHND for the improved APR to be recognized by the system. This can be done through depositing, withdrawing or claiming from the contract.

Last modified 1h ago

Copy link

Contents

veHND Staking System