Hundred Finance

Search…

Core Protocol

Protocol Governance

Developers

B.Protocol Backstop

A partner-project of the Hundred Finance platform

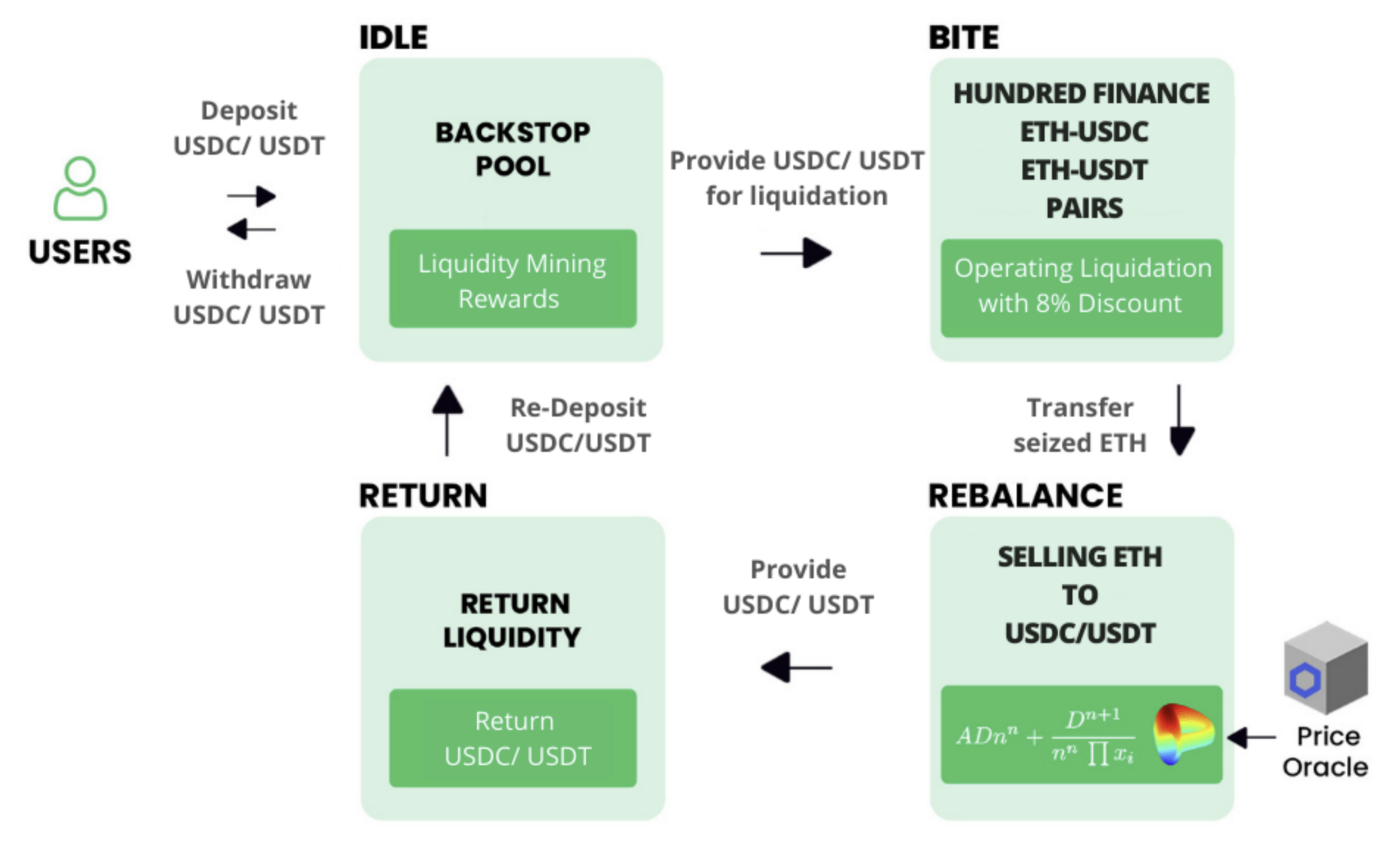

Hundred Finance is partnered with B.Protocol in the provision of a Backstop Automated Market Maker (B.AMM) product on its Arbitrum deployment. This service allows more efficient and democratic liquidations to be carried out without the need to develop complex flash bot integration. Instead, users contribute funds to the Backstop that are used in automated liquidations. In return, they receive the liquidation proceeds, as well as, at least during the initial phase, HND token rewards. This service will help maintain protocol health at the same time as value is directed back towards the participating community members.

B.Protocol: An Introduction

B.Protocol introduces its own DeFi primitive to the cryptocurrency ecosystem — the Backstop — a liquidity pool dedicated to liquidations. Thanks to B.Protocol’s innovative system, users are able to deposit assets into the backstop pool, and these funds can then be used to repay the debt of any vault or position for which liquidation is necessary in return for its (discounted) collateral.

B.Protocol — Hundred Finance Integration (High Level)

The discounted collateral that is seized during a liquidation is then automatically sold back to the asset that was used for the liquidation, and re-deposited, along with any accrued profits, back into the backstop pool for future liquidations. The collateral sale is being made through the B.AMM, the novel backstop AMM which was designed by B.Protocol and is optimized for liquidations, including those of large size positions.

This innovation solves two major issues that currently afflict the liquidation process as it exists today on many DeFi applications. Firstly, the B.AMM system diminishes competition between liquidators expressed as on-chain gas wars. This prevents a major form of value leakage as, up until now, the primary winners of overly competitive liquidation scenarios have been miners who, by accepting bribes in the form of inflated fees for confirming a particular liquidator’s transaction sooner, make transactions less economical for everyone. Secondly, B.Protocol’s technology onboards committed funds to be put towards liquidations. This prevents a scenario where there are insufficient keepers to secure the protocol. A scenario that could put lenders’ funds or even the solvency of the entire protocol is put at risk. Mitigating both of these issues is therefore critical to the stability of the DeFi ecosystem on any given day, and vital to the Hundred Finance platform.

Who Benefits from using B.Protocol?

Everyone (but miners…)!

- Hundred Finance “backstoppers�? who provide liquidity to our backstop pool, as they receive a passive yield by getting a share of liquidation proceeds and help to decentralize the liquidity provision for liquidations.

- Hundred Finance itself gets new and committed capital designated towards liquidations, thus bringing more stability to the platform. In the long run, this also provides a benefit due to a more stable platform enabling higher collateral factors (aka Loan-to-Value).

- The wider DeFi ecosystem gets another way to mitigate MEV and shift value from miners back to protocol users.

The team behind B.Protocol are a part of Smart Future Labs LTD, an Israel-based LTD company founded by Yaron Velner, ex-CTO of KyberNetwork, who was also part of the wBTC protocol development team and Smart Pool, the first decentralized mining pool over Ethereum. B.Protocol has been live on Ethereum L1 for over a year, with a current TVL of $100m. The first L1 backstop pool has over $25m of deposits and its design was audited by Fixed Point Solutions LLC. All adjustments necessary to integrate with the Hundred Finance protocol have been reviewed by the Hundred Finance team.

Integrating B.Protocol with Hundred Finance

Current markets with an active B.Protocol pool

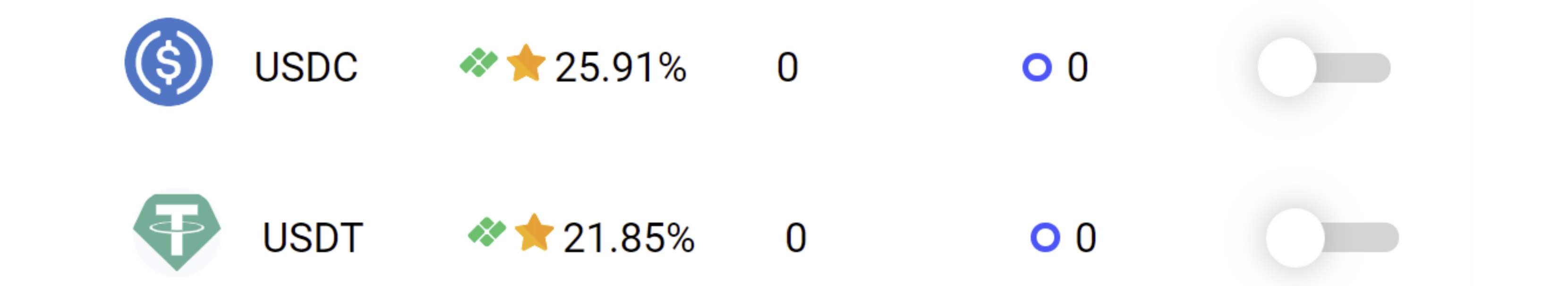

The first iteration of the B.Protocol backstop pools allows the deposit of USDC and USDT tokens into incentivized pools on the Arbitrum deployment. By navigating to Hundred Finance and selecting the Arbitrum network, users can observe that qualifying tokens feature the B.Protocol against the icon used to designate HND incentivized pools.

Adding USDT liquidity to the B.Protocol Backstop pool

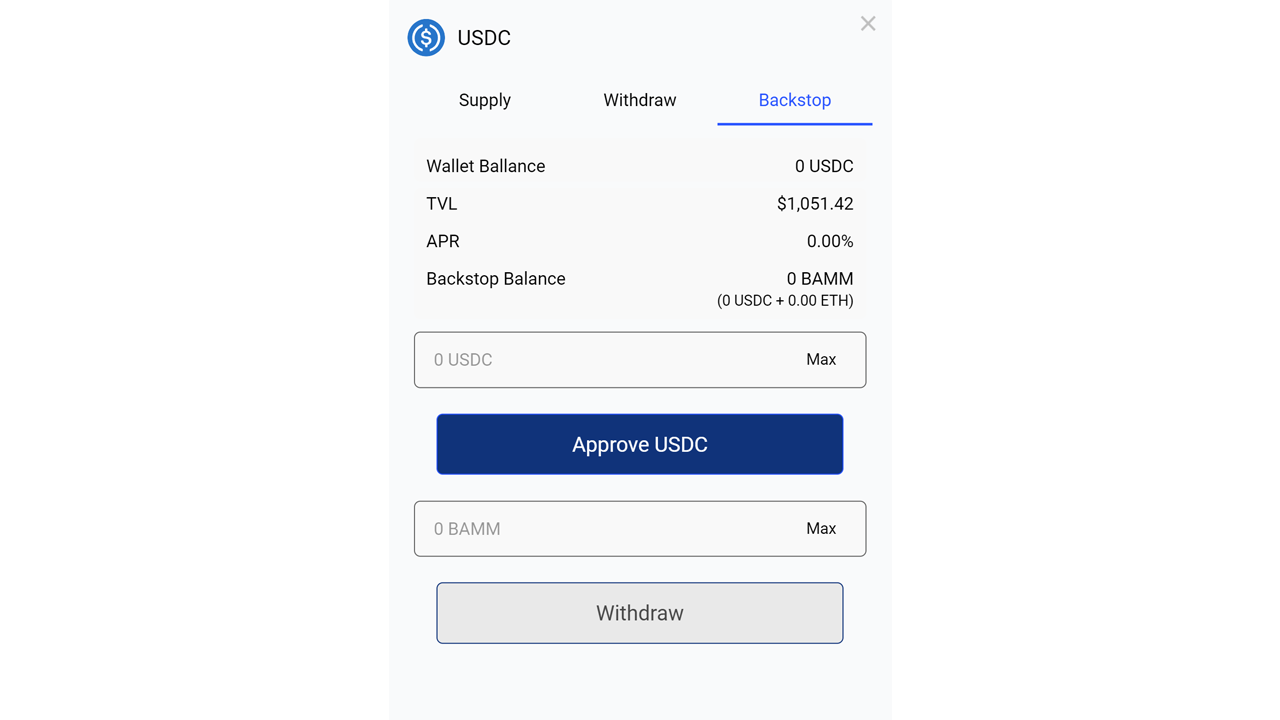

Selecting one of these two assets will then open a special deposit interface featuring a Backstop tab. This tab can be used to approve the relevant token, make deposits and withdrawals, as well as observe total value locked and the APR for added liquidity.

B.Protocol User Interface

For users of B.Protocol, our branding has been placed prominently in the Backstop section of the application. Visitors to the site are able to navigate directly to Hundred Finance using this link, from where they themselves can contribute liquidity to the initiative.

Last modified 6d ago